The first is that net income should not include any earnings set aside to pay dividends on preferred stock. There are two quick clarifications to make about EPS. Where Share Price is the most recent trading price for a given stock andĮPS = Net Income / Quantity of outstanding shares P/E is calculated using the following formula: Analysts compare a company’s P/E to those of key competitors or its industry sector, as well as a benchmark index such as the S&P 500.While simple and useful, P/E is not a comprehensive and conclusive valuation ratio because it does not account for a company’s growth prospects, nor does it consider whether the earnings are actually inflows or only earnings on paper.

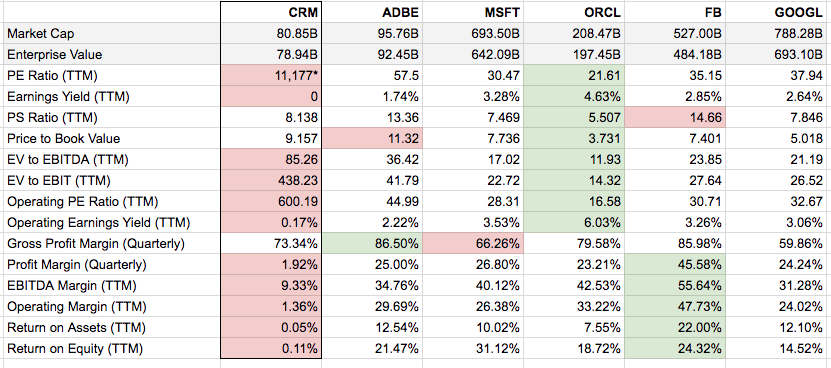

P/B compares stock price to book value, while P/S compares stock price relative to revenue. P/E differs from other market multiple ratios in that it only considers stock price and earnings.

This ratio is one of the simplest and most popular ways to value a company, and enables analysts to determine whether a company’s share price is overvalued or undervalued compared to its peers. This type of analysis is of particular interest to holders or potential buyers of common stock. The price-to-earnings ratio, or P/E, is a valuation ratio that compares a company’s common share price to its earnings per share, or EPS.

0 kommentar(er)

0 kommentar(er)